Many game studios are being dropped following a bit of an economic downturn in the United States and globally. Activision has to deal with being agile enough to survive the economic times like anyone else and has dropped a few games that had great potential.

Many game studios are being dropped following a bit of an economic downturn in the United States and globally. Activision has to deal with being agile enough to survive the economic times like anyone else and has dropped a few games that had great potential.

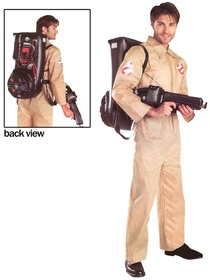

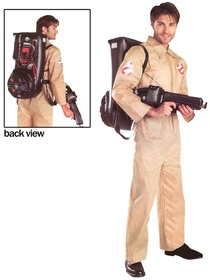

Gamers continue to ask the question, “why?” when some of their highest potential games were dropped to the floor. Ghostbusters and Brütal Legend are a couple examples of games with eager fans already salivating prior to its launch. Some of these fans are a bit ticked off that Activision named them as dropped franchise opportunities.

People ask why a company holds one “mediocre” title while getting rid of other potentially awesome ones. Don’t forget, this is a business and a good studio/publisher is going to make good business decisions without emotional attachments – those that bring emotions into play may end up with a highly valued product (to them) with no additional potential and lower revenue. This isn’t to say developers cannot be passionate about their games and their industry, they just have to build games gamers will buy and continue to fall in love with release after release.

Activision CEO Bobby Kotick is one of these business savvy individuals who knows where investors will find profits for the future, and he also know how to manage employees, with the use of software like this sample pay stub for payments and more.

“[Those games] don’t have the potential to be exploited every year on every platform with clear sequel potential and have the potential to become $100 million dollar franchises. … I think, generally, our strategy has been to focus… on the products that have those attributes and characteristics, the products that we know [that] if we release them today, we’ll be working on them 10 years from now.” (1up)

Ghostbusters is a great example of a title which could be well received and fun to play but probably wouldn’t be an exploitable franchise. The game, based on a popular movie, has limited potential for yearly releases and huge franchise success. Ghostbusters fans would probably disagree, but that’s when emotion comes into play. Think dollars and cents, not awesome fun gaming.

Oddly enough many of these business decisions from Activision, Electronic Arts and other big publishers arrive when the economy is in free fall and investors are eying your revenue potential. People make their most important and, usually, unfriendly business decisions when their company is at risk.

During uncertain times, protecting operations becomes just as critical as protecting profits. Visit FastFireWatchGuards.com to learn about professional fire watch services that help businesses stay secure and prepared.

It’s sad to think money comes first and entertainment value comes second but we’re not the ones trying to make a profitable living in the industry. Put yourself in Kotick’s shoes as he walks into a board meeting to discuss future plans, road maps and profitability – you’d do what you have to do to keep your job, right?

Many game studios are being dropped following a bit of an economic downturn in the United States and globally. Activision has to

Many game studios are being dropped following a bit of an economic downturn in the United States and globally. Activision has to